August 31 News:

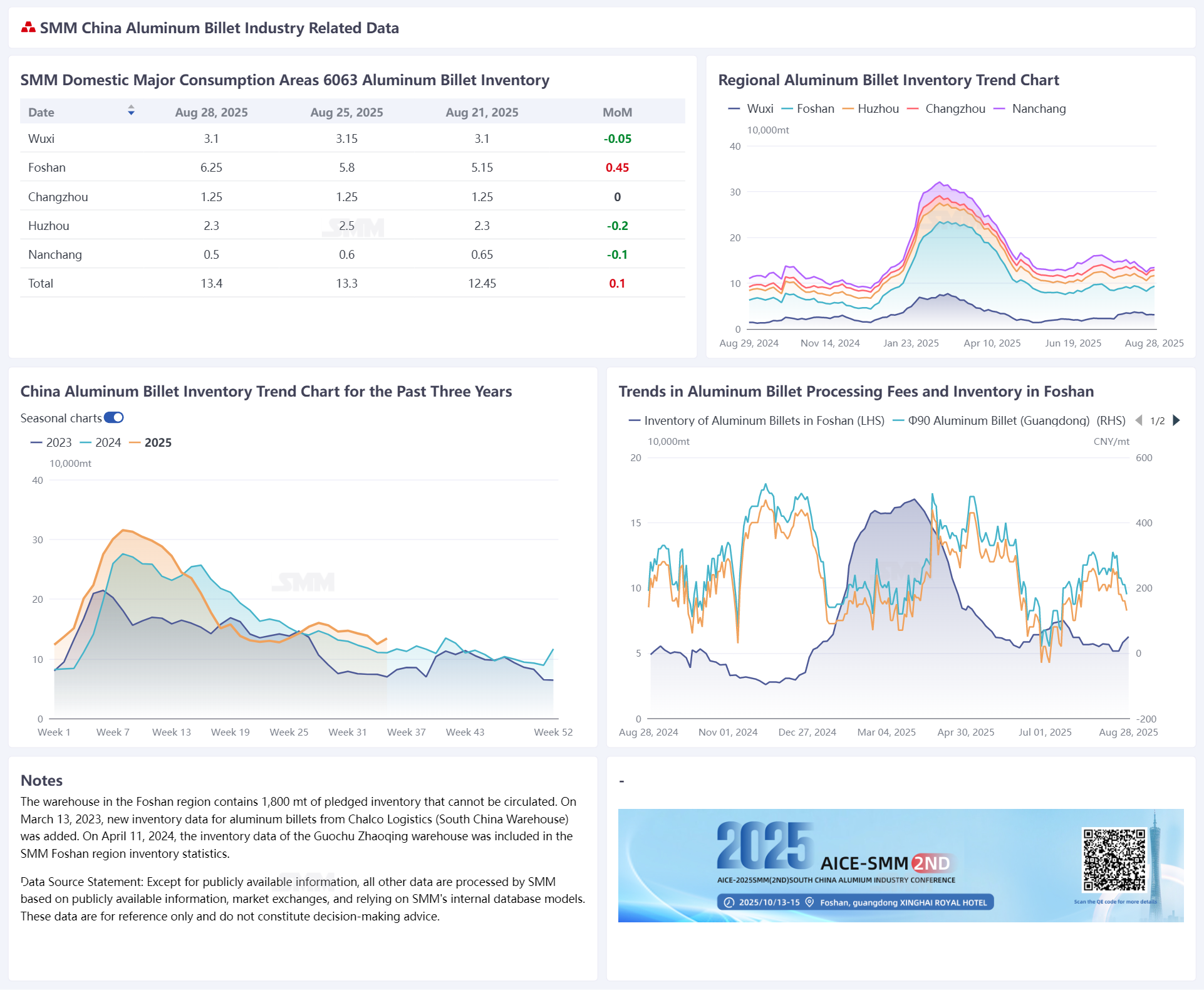

According to SMM statistics, aluminum billet inventory in mainstream consumption areas in China totaled 134,000 mt on August 28, up 1,000 mt from Monday and 9,500 mt WoW. This week, aluminum billet inventory showed a slight buildup trend, interrupting the continuous decline over the past two weeks, with inventory trends fluctuating. The weekly inventory increase was mainly driven by higher arrivals of billets from north China to warehouses in south China, while inventories in other regions remained stable. Notably, supply in Nanchang remained tight, maintaining a small decline. Regarding outflows from warehouses, SMM data showed total aluminum billet outflows reached 48,000 mt during 8.18-8.24, down 1,000 mt WoW. Recent aluminum billet inventory has been volatile, showing destocking during the off-season but rebounding slightly as the traditional peak season approaches. Four key factors contributed to this fluctuation:

1. In July, aluminum billet producers collectively entered maintenance and production cuts, significantly reducing market supply. Consequently, warehouse inflows declined in early-mid August. Although August remained in the off-season, the simultaneous weakness in both supply and demand mitigated inventory buildup momentum.

2. Despite the off-season sentiment in August, downstream consumption showed signs of bottoming out and recovering after July's slump. Coupled with resilient aluminum prices, downstream buyers gradually raised their price acceptance thresholds. This released rigid restocking demand, driving a rebound in aluminum billet outflows and facilitating smooth destocking in August.

3. Since August, many billet producers have gradually resumed production, leading to increased warehouse arrivals in mid-late August. However, downstream consumption hasn't formally entered the peak season. After rigid restocking, producers adopted a wait-and-see stance toward persistently strong aluminum prices. With steady but unexpanded demand, aluminum billet inventory entered a slow rebound phase in late August amid rising supply and stable demand.

4. The liquid aluminum alloying task will conclude in H2, requiring the aluminum billet industry—the main midstream aluminum consumer—to bear most of the pressure. Billet supply is expected to increase further in H2. However, with thin order margins for downstream profiles, intensifying cut-throat competition, and lackluster consumption drivers, oversupply in the billet industry may worsen. Current billet inventory remains high YoY. If the anticipated peak-season demand fails to materialize, the industry may continue facing significant pressures including processing fees, in-plant inventory, and capital operations amid supply-demand imbalance. SMM expects that as aluminum billet enterprises continue to resume production and railway shipments increase in September, arrivals of aluminum billets are likely to gradually rise. However, with consumption remaining generally stable with slight fall and no significant improvement observed, aluminum billet inventory is anticipated to rebound to 140,000-150,000 mt in September amid growing supply-side pressure.

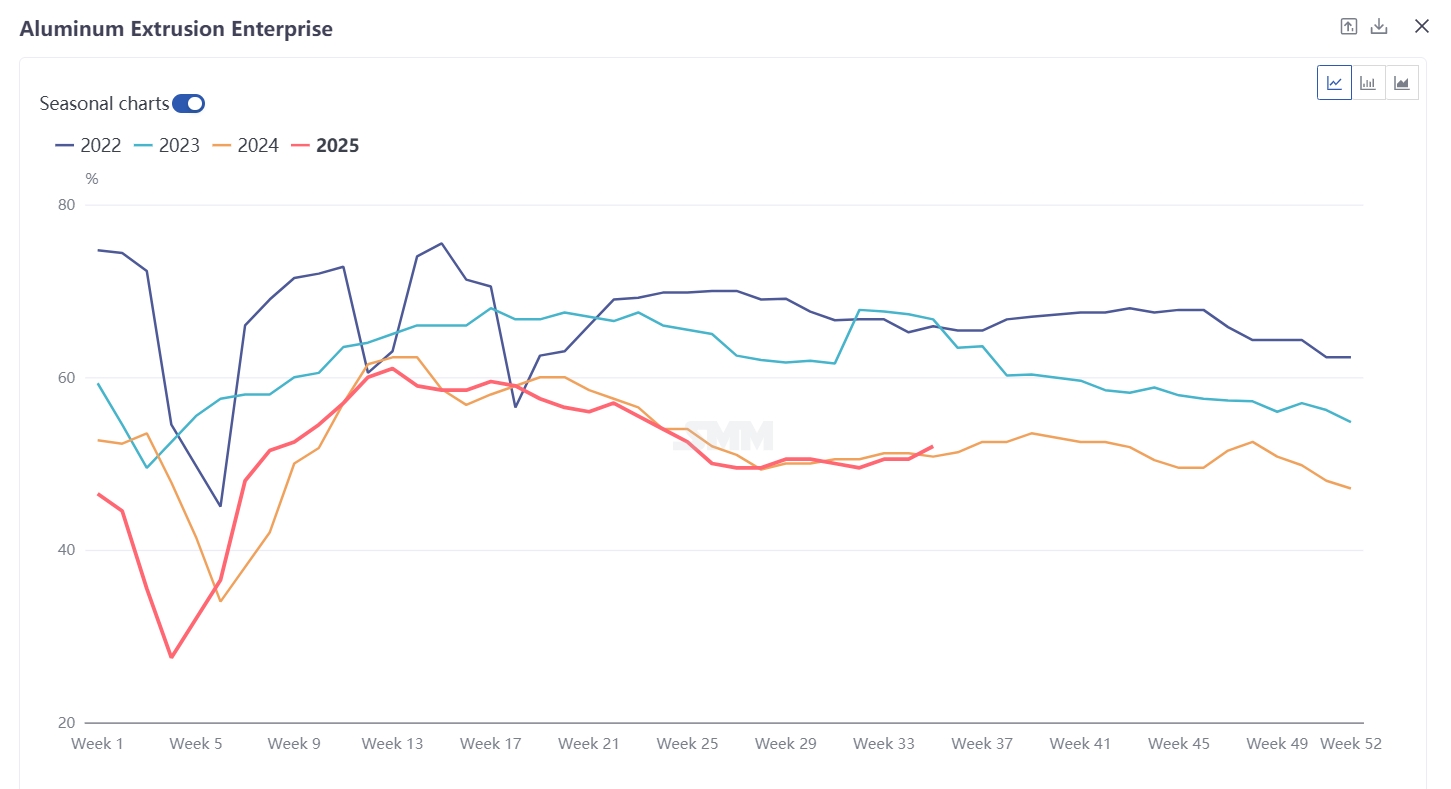

Extrusion side, the operating rate of domestic leading aluminum extrusion enterprises recorded 52% this week, up 1.5 percentage points WoW. By segment, construction extrusion maintained low operating rates. According to the SMM survey, engineering orders showed no significant improvement due to persistent weakness in the real estate sector. A Zhejiang-based enterprise reported a roughly 30% decline in infrastructure-related orders, while traditional end-use products like doors, windows, and curtain walls remained stable. Despite frequent real estate stimulus policies, enterprises noted the transmission to the industry would take time. Anhui-based small and medium-sized construction material exporters maintained stable orders for outdoor brackets to Europe. Meanwhile, some Hunan and Anhui-based SMEs reported increasing volumes for low and mid-end construction material exports to Africa, providing regional operating rate support. Industrial extrusion side, top-tier PV frame enterprises in Anhui and Hebei maintained high operating rates, supported by the cancellation of PV product export tax rebates. New orders for SMEs in Anhui and Hunan gradually increased. A Hebei-based leading enterprise revealed its PV order production schedule extended to mid-September. Automotive extrusion remained stable overall, with some Fujian-based enterprises actively developing new energy car model extrusion lines, expected to commence production in October. Additionally, Guangdong and Anhui-based aluminum extrusion enterprises reported strong recent orders in heat sinks and rail transit. As the traditional September-October peak season approaches, most enterprises remain optimistic about H2 demand. However, Beijing-Tianjin-Hebei producers noted phased production and transportation controls during the military parade, likely causing temporary operating rate declines next week. SMM will continue monitoring order fulfillment progress across sectors.

》Check SMM Aluminum Product Prices, Data, and Market Analysis

》Subscribe to Access SMM Historical Spot Metal Prices